ACHIEVE OPERATIONAL EXCELLENCE IN FINANCE

With Kure, all your teams can reduce errors, delays and operating costs without months of training, expensive consulting or confusing software.

Or book a demo

KURE FOR FINANCE OPTIMIZATION:

Reduce Loan Processing Times

Here’s how Kure guides teams to optimize processes. In this example, a Process Optimization Team uses Kure to reduce the time to process VA Mortgage Interest Rate Reduction Refinance (IRRRL) loans resulting in:

Increased customer satisfaction

Reduced operating costs

Increased underwriting capacity for more loan products

Increased employee satisfaction

67% Improvement in Loan Cycle Time

Step 1: What’s My Opportunity?

Clarify what optimizing the process will accomplish

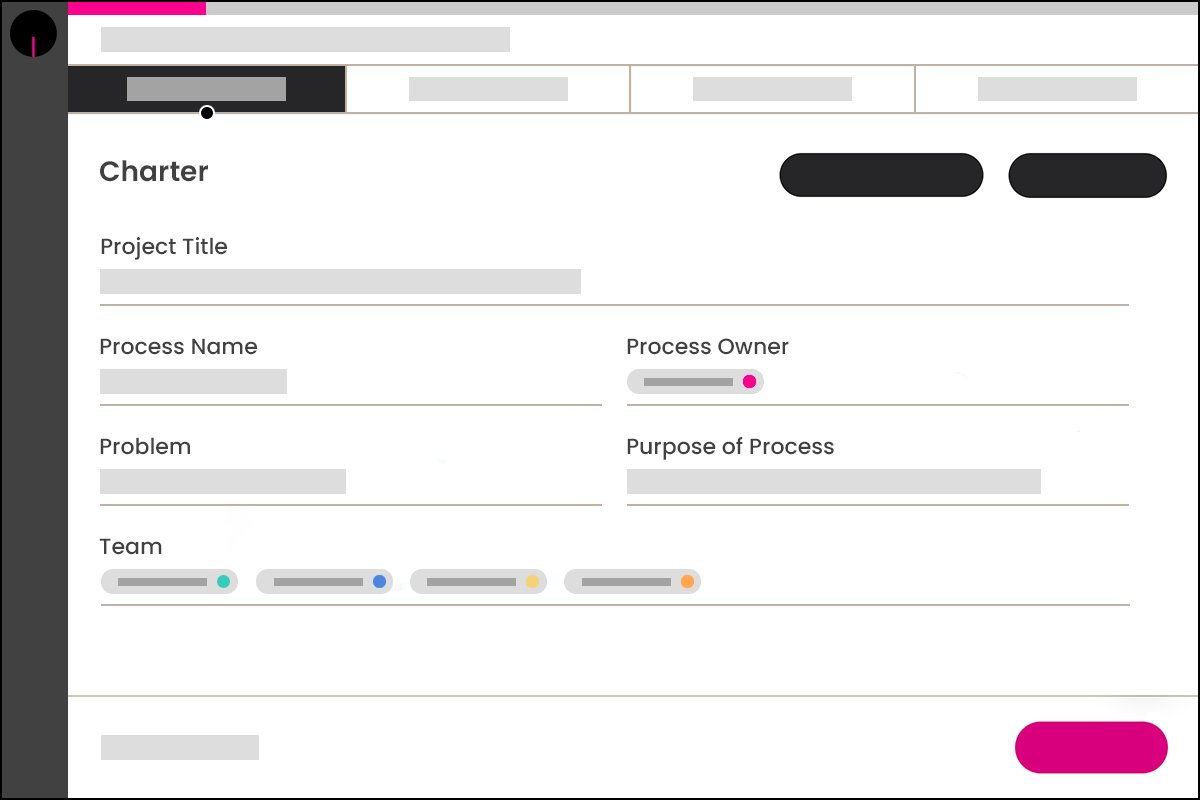

A mortgage lender was experiencing decreasing demand for the VA Mortgage refinancing product. A team was formed consisting of leaders and staff from the Mortgage, Operations, Underwriting and Processing functions.

Kure set their project up for success by clarifying their problem and goal, then automatically created their Project Charter, Plan and Timeline. The current cycle time from request to fund was 60 days, well over the industry standard of 45 days. The goal was to reduce the cycle time to 30 days or less.

“The current cycle time from request to fund was 60 days, well over the industry standard of 45 days. The goal was to reduce the cycle time to 30 days or less.”

Step 2: What’s My Process?

Explore the steps by which the work gets done and find opportunities

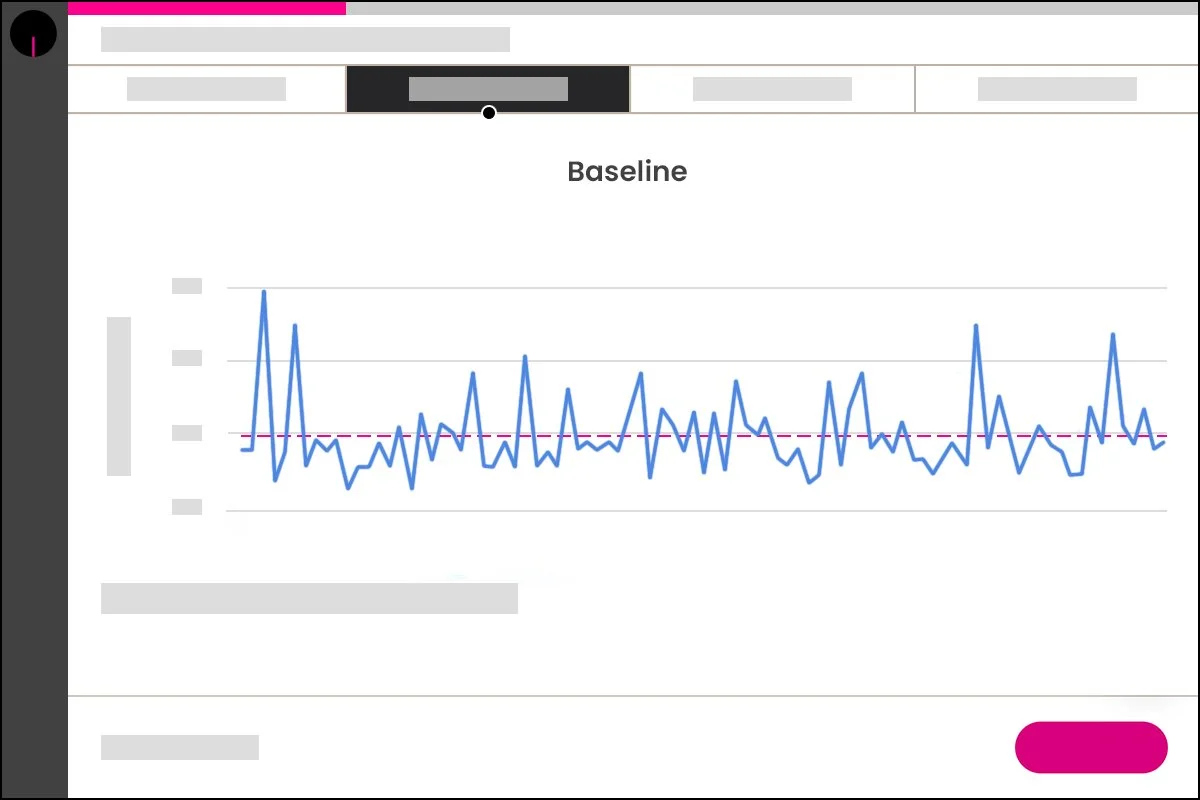

The team was guided to map out their current process, explore the loan process flow and collect data on its performance using Kure’s As-Is Map and Data Collection Tools.

Kure enabled the team to confirm the recent baseline loan cycle time. Currently, the process was averaging 60.3 days from application to fund. Kure’s AI, which includes Anomaly Detection, helped uncover several factors that could lead to improvement, like:

Excessive manual entry of information

Delays when using external supplied worksheets

Duplication of tasks across departments

Step 3: What’s Causing My Problem?

Identify one or more actionable items producing the undesired effect

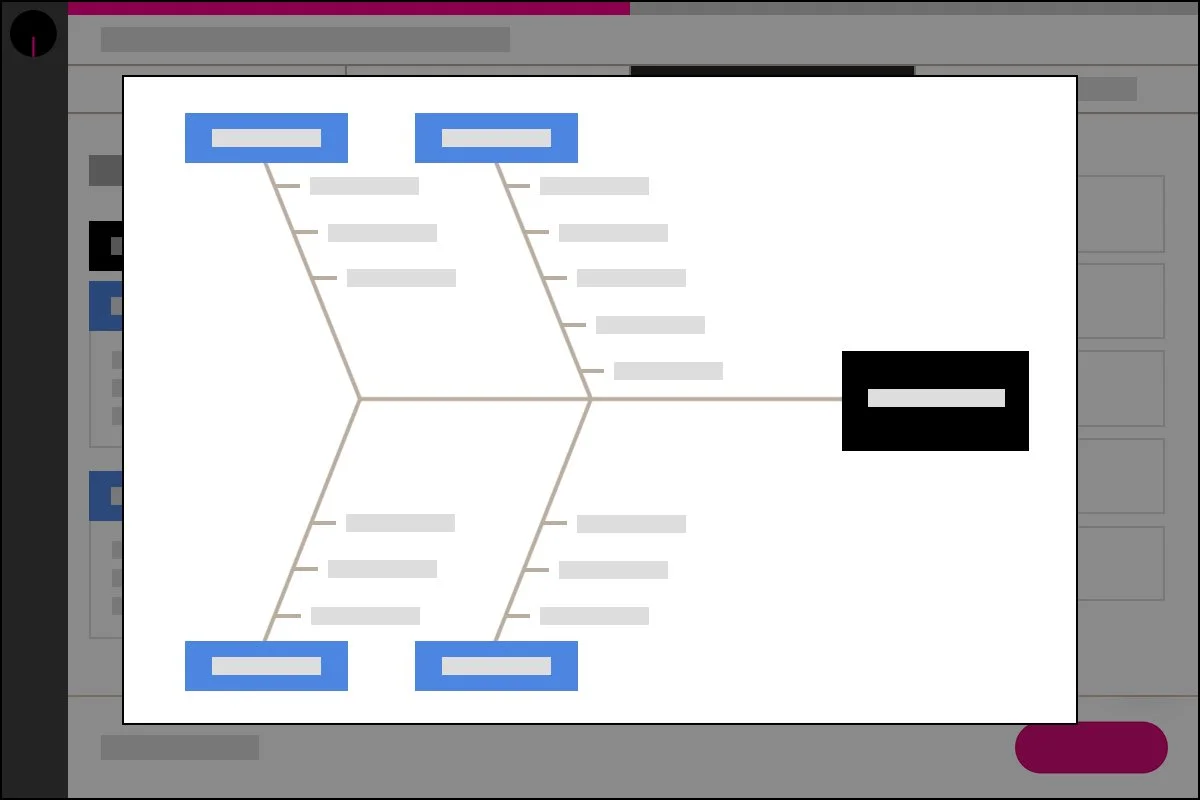

Using Kure’s Fishbone Diagram and 5 Whys, the team identified several root causes to the long cycle time, including:

Unnecessary touches by underwriting

Duplication of task due to unclear roles

Manual entry due to variation in external worksheets

Step 4: What’s My Solution?

Implement specific solutions to make the problem go away

Focusing on the root causes, the team generated, evaluated and implemented the best solutions using Kure’s Solution Selection Matrix which helped them visualize their options.

Certified processors to perform basic underwriting tasks

Eliminated duplicate tasks and clarified roles

Standardized external worksheets and increased use of soft files

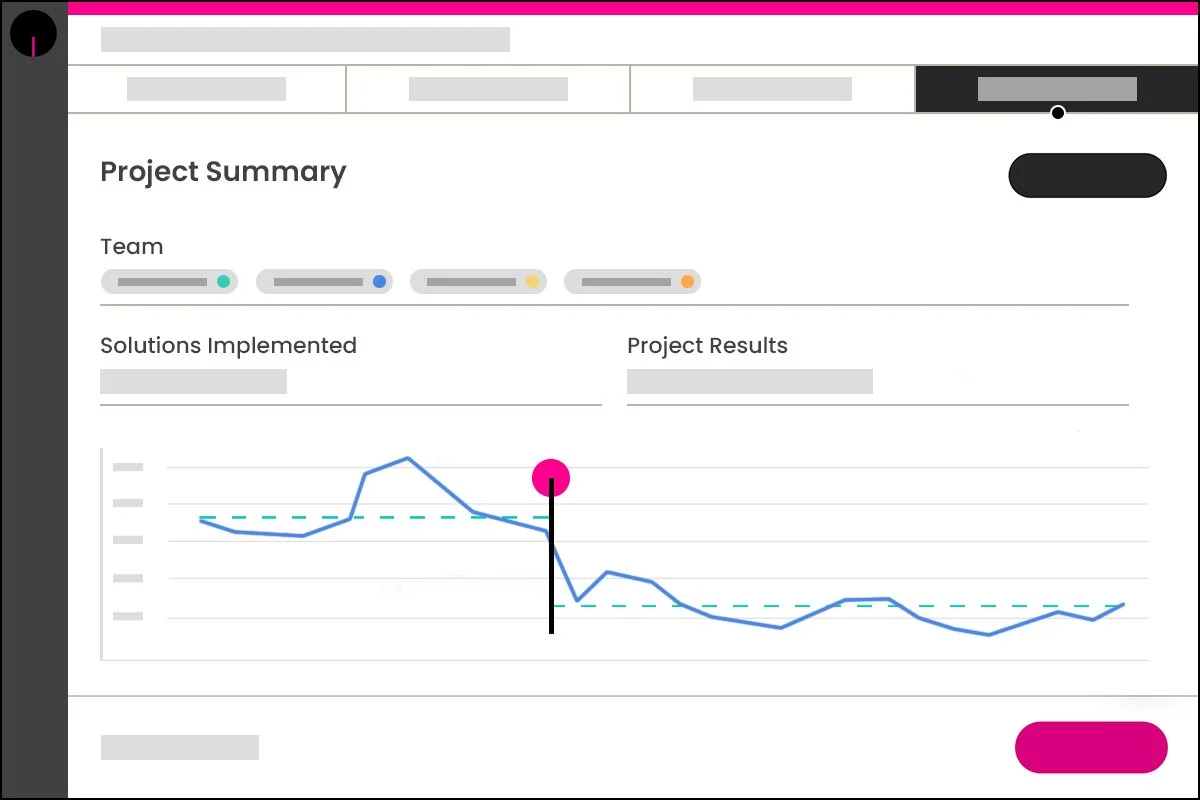

After implementing these solutions, loan cycle time was reduced from 60.3 days to 19.7 days (67% improvement), exceeding the goal.

Kure automatically generates this documentation alongside a Project Summary so the project team was able to easily communicate and celebrate their success — helping them efficiently transfer and scale their success throughout other loan operations.

“After implementing these solutions, loan cycle time was reduced from 60.3 days to 19.7 days (67% improvement), exceeding the goal.”

“Kure helped my team optimize processes without any expensive training. Its user-friendly interface made it easy for me to follow along and see optimization results.”

— Dr. Rosemarie T., Oahu Orthodontics

“No need for expensive training or consultants. Kure gives everyone the power to improve processes — from senior leaders to front-line staff.”

— Robert T., CIO, VA